Mortgage Rate Outlook 2025

The mortgage market has experienced notable changes in recent years, especially following the economic disruptions caused by the COVID-19 pandemic. As we approach 2025, understanding the trends of the past five years can provide valuable insight into what to expect next.

Mortgage Rates Over the Last Five Years

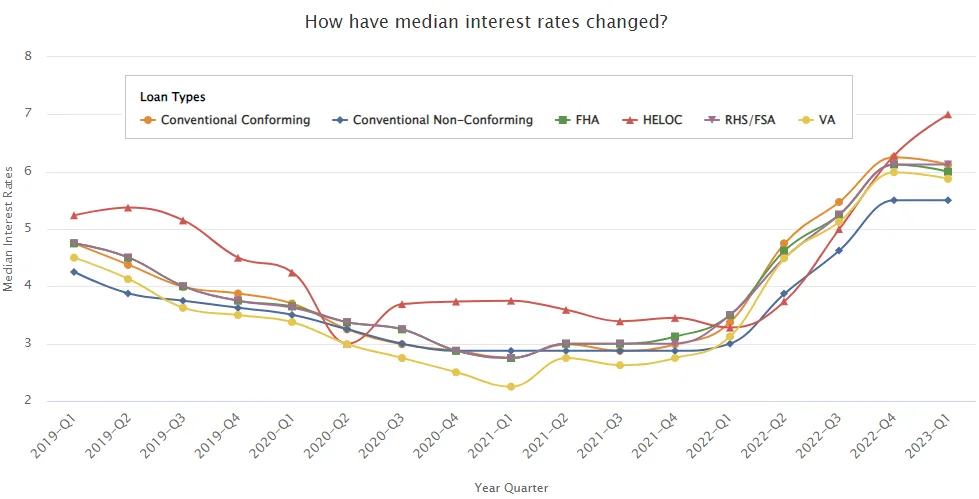

In the last five years, mortgage rates have fluctuated significantly. During the pandemic in 2020 and 2021, rates hit historic lows, with the average 30-year fixed mortgage rate dropping below 3%. However, as inflation surged and the Federal Reserve raised interest rates to combat it, mortgage rates climbed sharply in 2022 and 2023, peaking above 7%.

The chart above shows the recent upward trend in mortgage rates and the forecast for a potential decline to an average of approximately 6.3% in 2025.

Mortgage Rate Outlook 2025

Experts predict that mortgage rates will stabilize around 6.3% in 2025. This represents a slight improvement from recent highs but remains higher than the historically low rates during the pandemic. The forecast reflects expectations of moderating inflation and a more stable economic environment.

Mortgage Rates by Loan Type

Here of expected mortgage rates for various loan types in 2025:

- 30-Year Fixed-Rate Mortgage: Expected to average around 6.3%, providing long-term stability for borrowers.

- 15-Year Fixed-Rate Mortgage: Typically lower than the 30-year rate, expected to average around 6.1%.

- Adjustable-Rate Mortgages (ARMs): Initially lower than fixed-rate loans but subject to change after an introductory period.

- FHA Loans: Offering competitive rates with slightly lower averages than conventional loans but requiring mortgage insurance premiums.

- VA Loans: Designed for veterans and active-duty military members, these loans typically offer some of the most favorable rates on the market.

What This Means for Buyers

The anticipated decline in mortgage rates could provide a welcome respite for prospective homebuyers grappling with the challenges of a high-priced housing market. This potential easing of interest rates may offer hope for those priced out of the market in recent years. Lower rates could translate to reduced monthly payments, making homeownership more attainable for a broader population segment.

However, while a decrease in mortgage rates is undoubtedly beneficial, it doesn't solve the affordability crisis plaguing many housing markets. Home prices have surged significantly over the past few years, outpacing wage growth in many areas. This fundamental imbalance means that even with more favorable interest rates, many buyers will still face substantial hurdles in their pursuit of homeownership.

Given this complex landscape, it's it'slutely crucial for potential homebuyers to approach the market with a well-informed and strategic mindset. Here are some key considerations:

Explore All Loan Options

Buyers should thoroughly investigate the full spectrum of mortgage products available to them. This includes:

- Conventional loans: These traditional mortgages often offer competitive rates for those with firm credit profiles.

- FHA loans: Government-backed loans that can be more accessible for first-time buyers or those with less-than-perfect credit.

- VA loans: Available to veterans and active-duty military personnel, often featuring favorable terms.

- USDA loans: Designed for rural homebuyers, these loans can offer zero down payment options.

Each of these loan types has its own pros and cons, eligibility requirements, and long-term implications. It's Crucial to understand how each option aligns with your financial situation and homeownership goals.

Consider Locking in Rates

Locking in a favorable interest rate can be a significant advantage in a fluctuating rate environment. Many lenders offer rate lock options, allowing buyers to secure a specific rate for a set period, typically 30 to 60 days. This can provide peace of mind during the home search and purchase process, protecting against potential rate increases.

However, it is essential to weigh the benefits of locking against the potential for further rate decreases. Some lenders offer "float" down" opt"ons, allowing borrowers to take advantage of lower rates if they drop during the lock period, albeit usually for an additional fee.

Factor in Total Cost of Ownership

While a lower interest rate can make monthly payments more manageable, it's vital to consider the total cost of homeownership. This includes:

- Property taxes: These can vary significantly by location and add substantially to monthly housing costs.

- Homeowners insurance: Required by most lenders, this is an ongoing expense that needs to be factored into the budget.

- Maintenance and repairs: Homeowners should be prepared for unexpected costs associated with maintaining a property.

- HOA fees: For properties in certain communities, these fees can significantly increase monthly housing expenses.

By taking a holistic view of these costs, buyers can make a more informed decision about what they can truly afford, even in a lower interest rate environment.

Improve Credit Scores

Even with a general trend toward lower rates, individual borrowers' profiles will still play a crucial role in determining their specific interest rates. In the months leading up to a home purchase, potential buyers should focus on improving their credit scores by:

- Paying bills on time

- Reducing overall debt levels

- Avoiding new credit applications

- Correcting any errors on credit reports

A higher credit score can lead to more favorable loan terms, potentially saving thousands of dollars over the life of the mortgage.

While the anticipated decline in mortgage rates offers a potential bright spot for homebuyers, it's essential to approach the market with a comprehensive understanding of the challenges and opportunities at hand. By carefully exploring loan options, considering rate locks, factoring in total ownership costs, and working to improve credit profiles, buyers can position themselves to take full advantage of more favorable market conditions. Remember, the goal isn't to secure a home but to do so in a way that ensures long-term financial stability and satisfaction with your investment.